After its meeting on April 7, the Eurogroup stated that addressing investment weaknesses can increase the convergence of Member States' economies and foster the rebalancing process, thereby improving the resilience of the economic and monetary union. In this regard, the Eurogroup acknowledges the importance of EU-level initiatives, which are of specific relevance for the euro area, inter alia the Investment Plan, further deepening the Single Market and building a fully-fledged Capital Markets Union. At national level, further efforts should be made to improve the conditions for investment, not least to reap the full benefits of these initiatives.

The Eurogroup thus endorsed the following common principles, which should guide initiatives at Member State level when implementing reforms in this field:

Reforms should aim at promoting private investment and facilitating resource reallocation. Improving the business environment and the quality of public administration and addressing sector-specific bottlenecks will contribute to making product markets more reactive and flexible. These efforts should be complemented by labour market policies aiming at facilitating geographical, sectoral and occupational mobility.

Productivity enhancing public investment can play a crucial role and should be prioritised to boost growth in the short run as well as potential growth in the medium to long run, while ensuring full compliance with the SGP. In particular, investment in network infrastructure can have an important impact on growth and productivity. Public investment can also be mobilised to leverage private investment. In addition, fostering knowledge-intensive and sustainable growth, including via subsidies and incentives for investment in R&D and improvements in the quality of education can help increase the returns on investment.

Market-based sources of business financing should be developed to widen the range of available forms of financing. The availability of non-bank sources of financing - including venture capital, crowdfunding and market-based finance - can improve the resilience of euro area firms, and in particular SMEs, when confronted with an adverse shock and provide new opportunities for cross-border activities.

Read full press release.

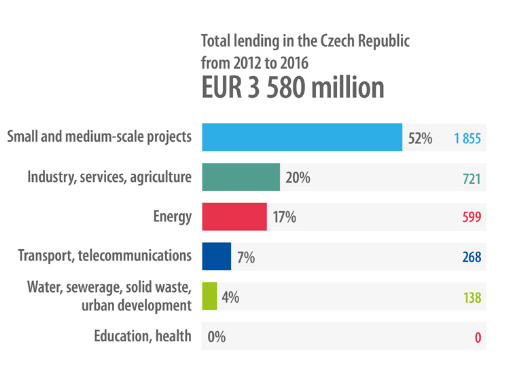

Meanwhile, European Investment Bank (EIB) investment in the Czech Republic came to EUR 526 million in 2016. Of this amount, 64% benefitted the country’s small businesses, while the country’s infrastructure accounted for 21%, innovation claimed 9% and loans to environmental projects represented 6% of the lending total. Over the past five years (2012-2016) the EIB has invested EUR 3.6 billion in the Czech Republic.

The total investment of the EIB Group (the European Investment Bank and the European Investment Fund) in the Czech Republic in 2016 was EUR 620 million. It is currently mostly SMEs that tap the support, says Hana Nylander Kaloudová, Head of the EIB Office in Prague in an interview for the Hospodářské noviny daily. As for big infrastructure projects, their preparation is not finished and they sometimes lack political support. A major problem is "very complicated building law", she said. Banks sometimes do not offer EU/EIB funding to SMEs, but their own products including higher interest rates, or sometimes, the banks are not willing to undergo the risk of EU/EIB funding, because there are enough other clients interested in taking a loan. she added. Read the article (in Czech).

Source: EIB

V roce 2016 činily investice EIB v České republice 526 mil. EUR. 64 % této částky podpořilo malé podniky, 21 % infrastrukturu, 9 % inovace a 6 % celkového objemu úvěrů financovalo projekty ochrany životního prostředí. Během posledních pěti let (2012-2016) investovala EIB v České republice 3,6 mld. EUR.

Celkové investice skupiny EIB (Evropská investiční banka a Evropský investiční fond) v České republice v roce 2016 dosáhly objemu 620 mil. EUR.

"Neděláme tu velké investiční akce, protože projekty nejsou připravené a někdy chybí i politická podpora, bez které se žádný strategický projekt neobejde," říká Hana Nylander Kaloudová v rozhovoru pro ihned.cz, která vede pražskou kancelář EIB. Upozorňuje zejména na nesmírně komplikovaný stavební zákon.Česko ale postupně začíná využívat jinou část Junckerova plánu, podporu malých a středních podniků. Banky, které podepsaly dohodu o poskytování úvěrů s pomocí evropských garancí, je klientům ne vždycky nabízejí. Peněz je na trhu nadbytek, takže banky někdy dávají přednost svým vlastním produktům, u kterých si mohou říct o vyšší úrok. Případně se, kvůli dostatku zájemců o úvěry, zdráhají jít do rizika, i když to je podstatou Junckerova plánu, píše ihned.cz.