Amendment to the Act on Investment Incentives

The amendment to the Act on Investment Incentives (Act No. 72/2000 Coll.) that took effect on 4 November 2020 is relevant also to the previously issued resolutions on promises of investment incentives. The amendment allows to the holders of the investment incentive promise to extend the standard three-year period for meeting of statutory general conditions that will allow to use the investment incentive by up to 2 years. If the investment incentive promise holder decides to file the application, it must concurrently prove that it is not able to meet the general conditions in the original period due to the spread of the Covid-19 disease and duly justify its statements. The application must be filed at least 30 days before the end of the original three-year period, and it is individually assessed by the Ministry of Trade and Industry. It is necessary to mention that the extension of the period for meeting of the statutory general conditions concurrently extends the ten-year period for the use of the provided income tax relief. Let us take an example of a recipient of an investment incentive who received the resolution on the promise on 1 July 2018, i.e., it must meet the general conditions listed in the resolution on the promise as of 1 July 2021. However, if it files an application for the extension of the period by 2 years on 1 April 2020 and its application is satisfied, it will be possible to meet the general conditions as of 1 July 2023 and the period for the use of a tax relief in the form of an investment incentive will be extended to 2032, inclusive.

Support for products of strategic importance

Another positive step is an adopted change in Government Decree No. 221/2019 implementing provisions of the Act on Investment Incentives, with effect from 26 December 2020. The principal change is the decision of the government to provide aid for investment projects involving production of selected products of strategic importance used for protection of lives and health of persons. The subsidised sector is a rather broadly defined group of medical devices (e.g., surgical masks, respirators, biohazard suits, face masks, and many others such as medicinal products under the Act on Pharmaceuticals). To support the production of medical devices, it is possible to obtain, in addition to standard corporate tax relief, material support of up to 10% of the incurred eligible costs. The change in the government decree concurrently resulted in a decrease in minimal limits of investments for obtaining of investment incentives, from the total of CZK 100 million to CZK 80 million (where CZK 40 million is the limit for the acquisition of machinery).

New map of state-subsidised regions

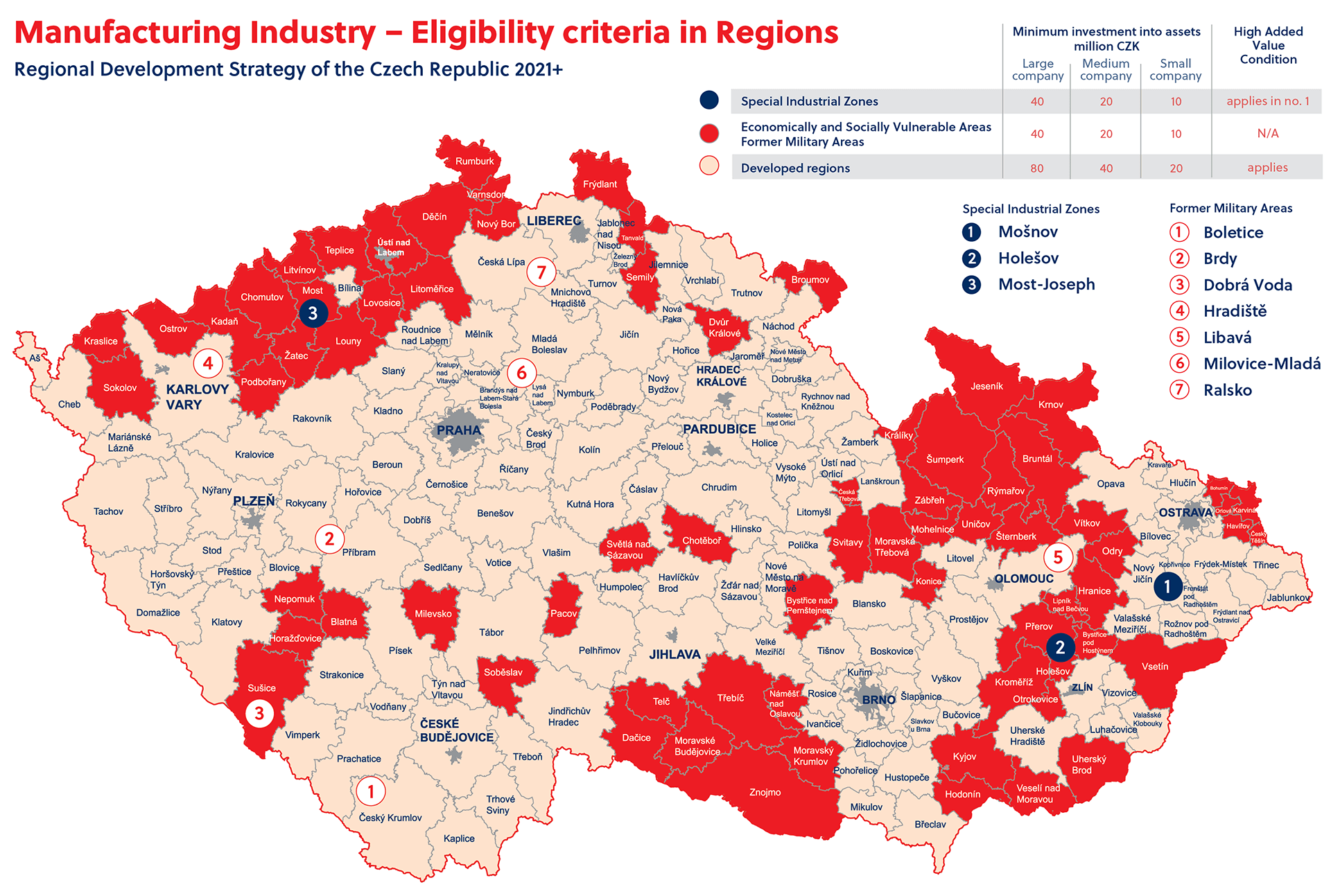

A new map with the definition of “state-subsidised regions” where there are half limits of investments has been in effect since 2021; newly, starting from 1 January 2021, former military areas such as Ralsko, Milovice, etc. (refer to the figure below) have been included in the subsidised regions.

Source: CzechInvest

However, the necessity to prove and document the benefit of the investment for the region and the state upon the filing of the application remains to be valid for all regions. The document has a determined form, and it should contain a social responsibility of the applicant, for example in respect of the environment, employees, disadvantaged persons, development of the district or the region. For the applicants who do not fall into the category of state-subsidised regions, it is necessary to meet the condition of higher added value of the investment, i.e., 80% of the employees at the place of the investment project must have the minimum average monthly gross salary in the region and concurrently:

The final approval of the application for an investment incentive is newly decided by the Czech government.

Existing forms of public aid by 2022

The level of public aid in the form of investment incentives applicable by the end of 2021 is 25% of the value of the eligible costs for all regions outside Prague. The aid is calculated from the amount of the investment up to

EUR 50 million, for the part of the eligible costs exceeding EUR 50 million, the aid is reduced to half, i.e., 12.5%.

If a company plans to invest an even higher amount, the aid is further reduced, and its granting is additionally conditioned by an approval from the European Commission. To calculate the available support, all investments made by one group of investors in one region during three years are always assessed together.

The most frequent form of investment incentive is a corporate income tax relief, for up to the period of 10 years. Other less frequent possibilities of aid include a transfer of a plot of land for a discounted price, material support for the acquisition of assets in a strategic investment, material support for the creation of new jobs or retraining of employees and exemption from real estate tax in preferential industrial zones.