Blanka Vačkova, Head of Research at JLL, shared the latest EMEA data showing that offices have remained in the spotlight for investors, accounting for 38% of the total investment volume in 2020, although the investment activity in the office sector decreased by 27% yoy. Investment in retail and hotels registered a decline of 22% and 59% yoy, respectively, and investment in industrial and residential assets („beds and sheds“) increased by 16% and 20% yoy, respectively.

As for the Czech Republic, due to restrictions on travel, the share of domestic investors was high (58% of the total) in 2020. Investment into offices made 50%, retail over 20%, and industrial below 20% of the total investment (industrial rather due to lack of product than the pandemic). Manufacturing should not be given up on in the digital era. Investor demand is currently fully supporting manufacturing and logistics, commented Mike Atwell, Executive Director, Head of Capital Markets CEE and the Czech Republic.

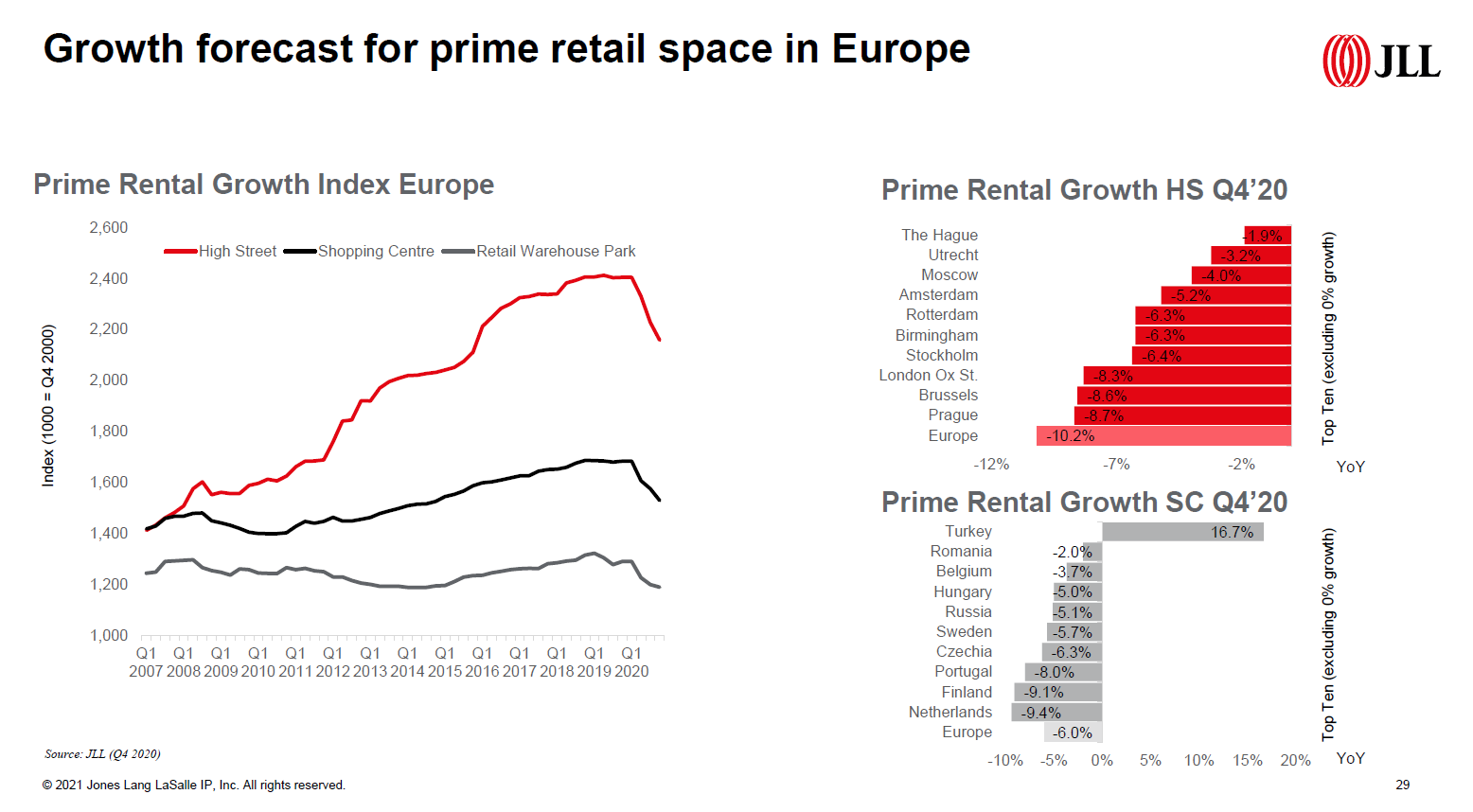

In the retail sector, Covid 19 proved as a strong accelerator for internet shopping across Europe. The yoy increase for the entire year 2020 stood at 28% in the Czech Republic and 33% in Europe. The correlation between the closure of shops and the rise of internet shopping is shown by a -9% and -11% decrease of total retail sale in March and April, accompanied by internet sales growth in April 2020 by 48% yoy. Clothing was one of the most hit categories with a yoy drop of -26% in the EU and -30% in the Czech Republic. Nevertheless, physical retail space remains key for retailers to thrive. For larger restaurants of 400 or 1,000 sq m size, it may be difficult to find agreement with banks, because they were focused on tourists or company events that are not happening at the moment, commented Tomáš Soukup, JLL’s Head of Retail Czech Republic and Slovakia within a debate.

According to Petr Florián, Head of Office at 108 Agency, there is 100,000 sq m of office space to be completed in 2021, although some developers are slowing down the construction. Vacancy rate has remained stable for now, but the subleasing activity has increased. Renegotiation stood behind 46% of the 2020 leasing activity, compared to 38% in 2019. Lot of companies/tenants currently focus on renegotiation of conditions in the current office space (sometimes only for short period in order to delay decisions). We can observe the tenants’ market nowadays with advantage resting on the tenants’ side.

The pandemic has not affected much the construction of industrial real estate, said Dušan Drábek, Head of Industrial & Logistics Agency, Director for Czech Republic & Slovakia at BNP Paribas, because the projects were planned in advance. 650,000 sq m of space were supplied in 2020, compared to 740,000 in 2019, but it is difficult to say whether the reason behind was Covid or the lack of land. All leases below one year doubled compared to 2019, added Kamila Breen, Head of Market Research and Consultancy Czech Republic and Slovakia at BNP Paribas. New trend is a green building with environmental certificates, leading to rising demand from banks and tenants to build green, and possibly in higher price of the logistics assets. Another trend are mega distribution centers.

Blanka Vačkova, Head of Research, JLL

Blanka Vačkova, Head of Research, JLL

„Domestic demand is necessary for the economy to pick up. There is lot of uncertainty on the market. Looking forward, governments are providing fiscal support, pouring money into the economy, and keeping unemployment low across the continent. We will see the full impact on the market once this support is lifted.“

There is a widening divergence between the manufacturing and the services sector in the Czech Republic. Lot of manufacturing in the Czech Republic is high-value-added manufacturing. „We should not be giving up on something that we are good at.“

„The outlook depends on how the pandemic evolves, and vaccination will play a key role. Government support is important to tackle the damage caused by the pandemic.“

“The market will recover from 2022 and the market sentiment is ready to improve with vaccination.”

The construction activity that was put on hold should start to return in 2022 as lease contracts start to expire, including those who prolonged lease for 1-2 years only, or the subleased space tenants with expiring lease contracts. More activity is expected also with employees returning to the office again.

„For the tenants, this is the year to take action.“

„Even if we are fully vaccinated, there will be definitely hygienic and health measures in place to avoid any kind of new pandemic.“

Dušan Drábek, Head of Industrial and Logistics, BNP Paribas

Major part, more than 1/3 of the total stock is located in Greater Prague, followed by Brno and Pilsen regions.

“Most of the space is prepared in the Pilsen region, due to proximity to German market.”

Ecommerce gave a stimulus for new leases on the market with a number of projects commenced last year, including ecommerce, consumer goods, automotive related to Germany.

CEE countries are strengthening their position, but Poland has the advantage of a favorable environment for setting up mega distribution centers (bigger than 40,000 sq meters).

Kamila Breen, Head of Market Research and Consultancy, BNP Paribas

Czech developers are struggling to bring to market big distribution centers due to administrative and legal obstacles. There is movement in the sector of mega distribution centers.

“New regions are being sought and the Czech Republic should be ready.”

AmCham Real Estate Council is an expert platform that focuses on market analysis and development of evidence-based policies, in the areas of urban development and the future of work.