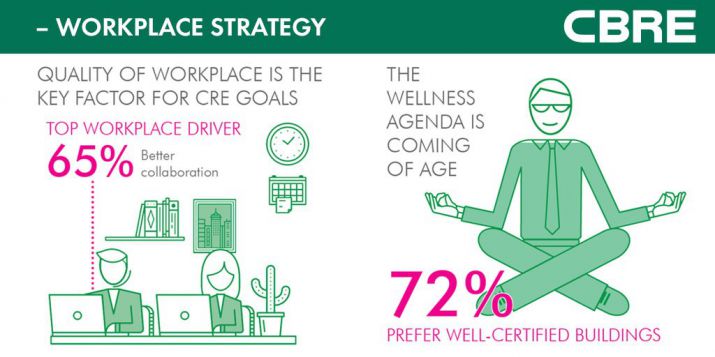

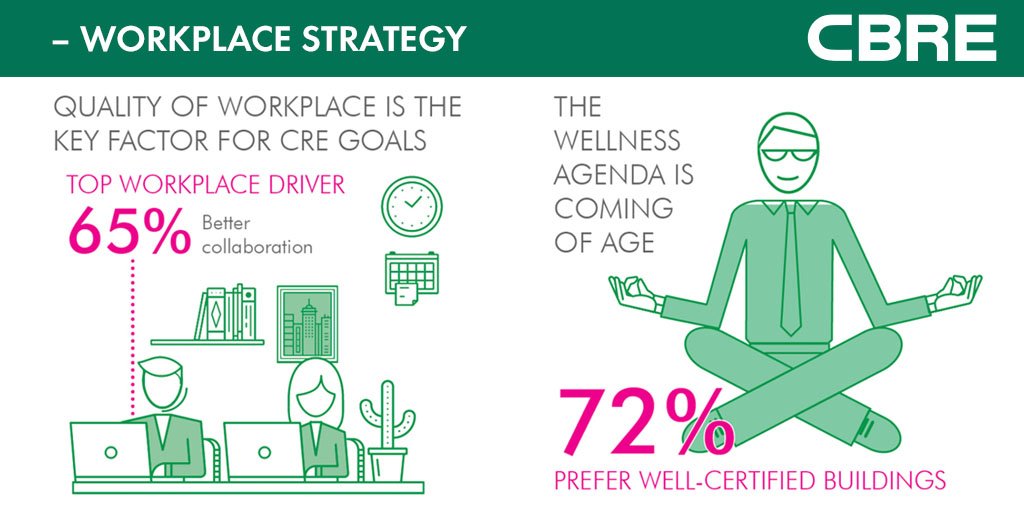

In recent years, major occupiers have looked to actively manage their cost base while remaining open to expansion and growth opportunities. Some of the measures implemented early in the recovery cycle have been exhausted but, at the same time, corporate thinking around workplace, wellness, and flexible working models has evolved.

Investors preparing for the future should consider how shifts in occupier thinking and priorities affect their portfolios and asset selections. By future-proofing assets and anticipating new forms of occupancy, like shared and flexible space, they will be better placed to attract and retain occupiers over the coming years.

The European Occupier Survey, now in its seventh year, polls real estate decision makers at 130 companies to understand their objectives and associated challenges across a broad range of issues.