With a number of important recent and upcoming developments in the OECD's international tax work, the OECD's Centre for Tax Policy and Administration (CTPA) gave the latest tax update. Topics included:

G20

Inclusive Framework on BEPS, including the Multilateral Instrument

Tax transparency

Tax certainty

VAT/GST

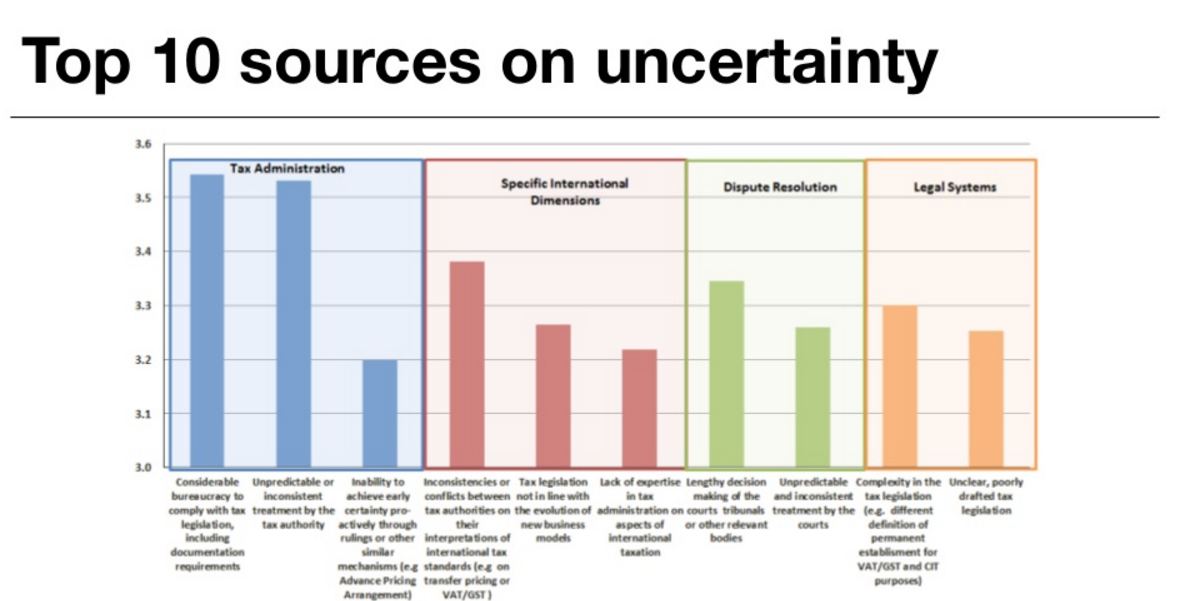

As for tax ceratinty, OECD conducted a survey among businesses with global headquarters in 62 countries and regional headquarters in 105 jurisdictions. 66% of respondents were tax directors or senior tax managers. OECD received 724 completed responses. Results follow:

A. Tax Administration

1. Considerable bureaucracy to comply with tax legislation, including documentation requirements

2. Unpredictable or inconsistent treatment by the tax authority

3. inability to achieve early certainty pro-actively through rulings or other similar mechanisms

B. Specific International Dimensions

4. Inconsistencies or conflicts between tax authorities on their interpretations of international tax standards (e.g. on transfer pricing or VAT)

5. Tax legislation not in line with the evolution of new business models

6. Lack of expertise in tax administration on aspoects of international taxation

C. Dispute Resolution

7. Lengthy decision making of the courts tribunals or other relevant bodies

8. Unpredictable and inconsistent treatment by the courts

D. Legal Systems

9. Complexity in the tax legislation (e.g. different definition of permanent establishment for VAT/GST and CIT purposes)

10. Unclear, poorly drafted tax legislation.

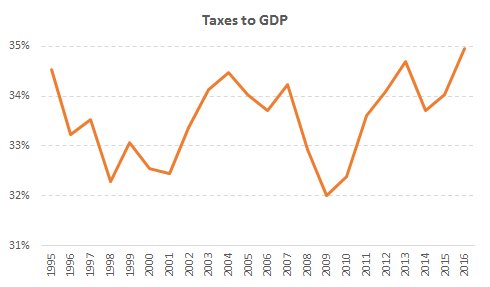

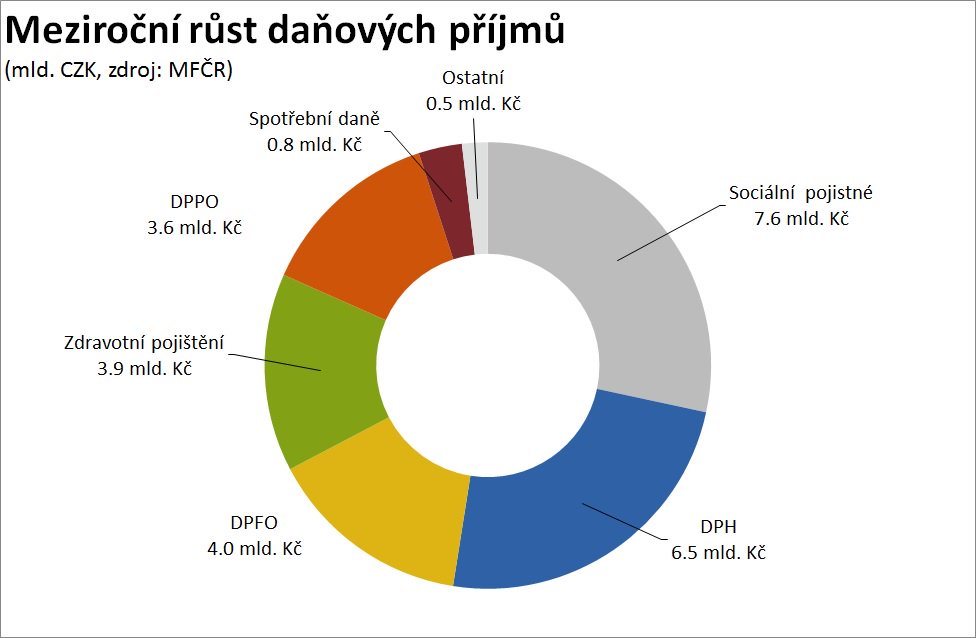

View also infographics on the Czech Republic:

Source: Deloitte CZ

Source: CSOB