Whether it be the florist around the corner or the local pub, many businesses have had to shut shop and quickly think of alternative business models as a result of the coronavirus. But a number of these have neither an online shop nor digital payment facilities. ‘We’ve now very swiftly been able to change this. Teaming up with Global Payments, we have created a simple new solution: We’re providing online payment solutions that business-owners, some of whom are now suddenly having to do home deliveries, can start accessing very quickly’, says Peter Bosek, CEO of Erste Bank.

There are essentially two options available: Either an entirely web-based solution, whereby brick-and-mortar retailers just send their customers a payment link for ordered goods. Or a compact, mobile, easily disinfected payment terminal that is taken with them to home deliveries.

Fast online payments without an online shop

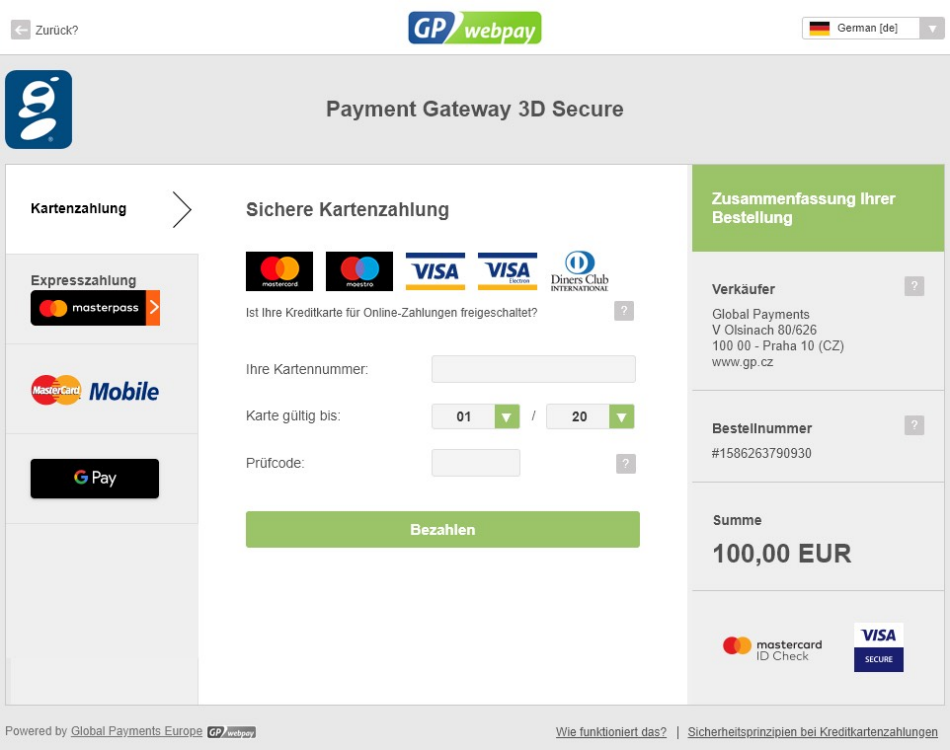

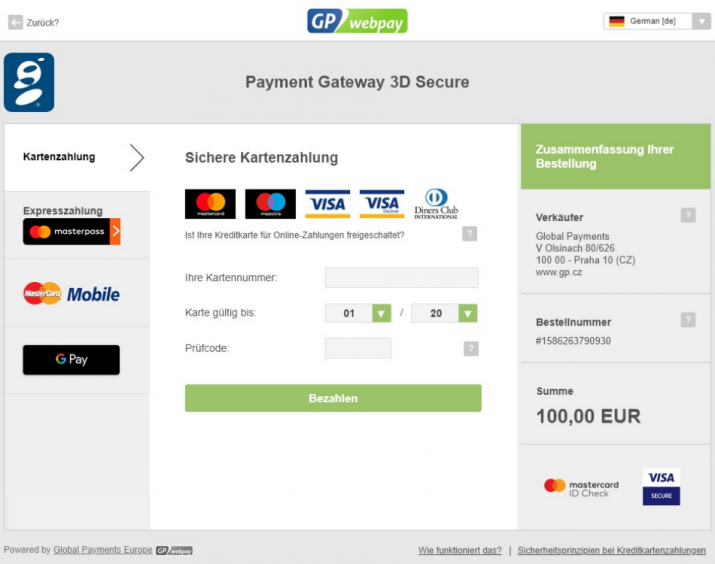

In the case of the web-based solution, the business-owner logs into their browser via a web app and creates a payment link for the respective customer. Any customer who has ordered something will be sent this link by email, SMS or WhatsApp. In the back-end, Global Payments will provide a payment interface similar to that found in web shops. This will contain the retailer’s name and a description of the ordered goods, and customers will be able to pay by debit or credit card, as is also the case with other online retailers. Once the customer has paid, the goods will be delivered.

Retailers can also integrate the ‘GP webpay’ payment portal into an existing web shop using a plug-in, though it is not necessary to have an online shop. This is particularly beneficial to retailers selling perishable goods, such as flowers or food, because they can be delivered in real time.

Contactless mobile payments using POS terminals

The other option is a mobile payment terminal that is simply brought along at delivery. This allows payments to be made hygienically and securely on site, because they enable contactless payments via credit and debit card. The compact size of the terminals means they are also particularly easy to disinfect. The mobile POS terminals can be delivered to retailers two to five working days after the contract has been signed. ‘As a bank with regional roots, we at the Sparkassen Group also want to provide as much assistance as possible to regional retailers who have had to change their business models at short notice. They can now receive their payments quickly and securely, and thus also provide prompt deliveries’, says Bosek.

The basic monthly fee of 19.90 Euros for the service will be waived for the first three months due to the current coronavirus crisis.

Successful co-operation

Erste Bank und Sparkassen are offering these cashless payment solutions in co-operation with Global Payments Inc., with whom the Erste Group has already been partnering since 2015. The service provider offers a number of innovative payment solutions for shops, retailers and online stores. Global Payments has been operating in Austria since 2019, and has 50 years’ experience in the worldwide payment sector. In addition to Austria, the joint venture also has a presence in the Czech Republic, Slovakia and Romania. Global Payments and CaixaBank collectively have a majority holding of 51 percent in the joint venture; the remaining 49 percent is held by the Erste Group.

For more information, visit https://www.sparkasse.at/sgruppe/unternehmen/produkte-firmenkunden/cash-management/zv-services/bankomatkasse