The stock exchange-listed Erste Group is optimistic about the current financial year. This optimism is based on the forecast economic upturn of between +3% and +6% in the economies of Central and Eastern Europe (CEE). Despite the trailing effect of insolvencies in Austria and the CEE region, the bank expects that the current year will see its risk costs come in lower and its profits rising once again

„I am confident about the year 2021. We should experience a clear upswing in our region’s economies this year – and with it, a change of sign, from minus to plus,“ says Erste Group CEO Bernd Spalt. This optimism regarding an upswing is based, among other things, on the fact that vaccination coverage of the population is increasing in a moderate but steady manner.

EXPANSION FOLLOWING RECESSION

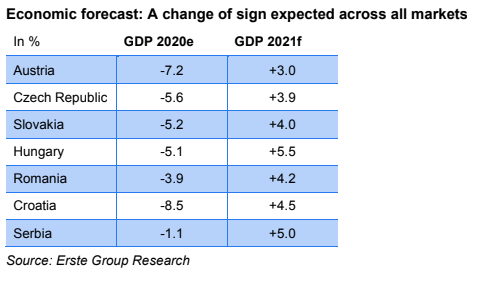

The Corona pandemic caused the CEE economies to enter into recession in 2020, although that economic contraction has turned out to be less severe than had been originally assumed. While the impact on Serbia was comparatively mild with a GDP decline of -1.1% in 2020, the Croatian economy plunged by -8.5% compared with 2019. In Austria, the GDP decline in the past year was also comparatively strong at -7.2%. According to preliminary data, the GDP downturn in 2020 amounted to -5.6% in the Czech Republic, -5.2% in Slovakia, -5.1% in Hungary and -3.9% in Romania.

Erste Group sees a turnaround in 2021, with the strongest GDP growth expected in Hungary (+5.5%) and Serbia (+5.0%). The economies of Croatia, Romania and Slovakia should all also grow by more than 4%, with the Czech Republic very close behind with an expected rise of 3.9%. The GDP dynamic that some CEE countries evidenced in the final quarter of 2020 gives reason for optimism: the Hungarian, Slovak and Romanian economies unexpectedly posted growth in Q4 2020 compared with the preceding quarter - despite the dampening effect of the lockdown measures in the respective countries.

SIGNFICANTLY BETTER RESULT EXPECTED IN 2021

Given these economic forecasts, Erste Group expects to post a better financial result in 2021. "We will also see a clear change in the dynamic of our earnings development," says Erste Group CEO Spalt. The banking group's net result fell by 46.7% to 783 million euros in 2020 due to the formation of high risk provisions, but is expected to rise again in 2021.

ONLY "TRAILING EFFECT" IN INSOLVENCIES, LOWER RISK COSTS

The Erste Group CEO does not see an oft-cited „insolvency wave“ hitting the region’s economies: “The signals we see now that the moratorium programmes are running out tend to be positive. The expiry of the state aid programs will, of course, contribute to insolvencies, but only as a trailing effect from previous years.”

Based on internal forecasts, Erste Group expects growth in the current year in both its lending volume and in the net commission income its generates through its fund management, securities, and insurance brokerage business. The bank can therefore expect - despite negative interest rates in the euro area – to post a rising operating result. In addition, it sees risk costs declining in 2021. Overall, Erste Group aims to improve its net result in the current year.

"The economic upswing will provide us with an opportunity to bring about an ecological turnaround and also enable decisive progress in digitization," Spalt is certain. The EU will invest large parts of its more than 700 billion euros recovery fund in climate-friendly and digital projects.

“As a bank, we want to support this transformation. We see ourselves as a companion to the companies and economies of our region. That’s why our growth will be built primarily on sustainability.“