“Erste Group is entering this current crisis as a very profitable bank with strong capital and liquidity. This allows us to be a reliable and stable partner for our customers,” said Bernd Spalt, CEO of Erste Group. “The economies in our region have weathered the Covid crisis well and so far are also proving resilient in the current crisis, thanks mainly to a strong 2021. In a favorable scenario, the economic recovery could have continued. However, the war has changed everything, calling into question not only peace in Europe, but also such fundamental things as energy and food security. We continue to expect the region’s economies to grow, albeit at significantly weaker rates.”

Subdued GDP growth and increased inflation in 2022

Before the war in Ukraine, the economies in CEE were experiencing a dynamic recovery from the pandemic-related slump. However, the war -- aside from bringing about a humanitarian catastrophe --marks the second economy-wrecking crisis event in the space of just two years.

To be sure, Russia's economic role as an export market for the CEE economies has steadily declined in recent years; Russia is not among the Top 10 trade partners for most countries in the region. However, most countries - above all Austria, Czechia and Slovakia - still depend on imports of Russian energy sources, especially natural gas.

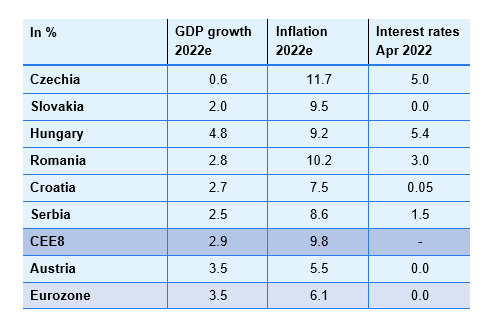

Inflation rates are rising, mainly due to increased energy and food prices. While Erste Group estimates inflation in Austria at 5.5% for 2022, it is likely to be in the high single digits or even double digits in a number of CEE countries, up to 11.7% in Czechia. This will affect purchasing power and, subsequently, GDP growth. Overall, Erste Group expects an average GDP growth of around 3% for the banking group's markets in 2022 – and thus below the current expectations for the euro zone. In addition, the war’s impact on trade adds to already existing supply chain issues. The sanctions being applied against Russia will also leave their mark on Europe’s economies.

Despite all these challenges, we believe that due to the still robust situation concerning orders, the year 2022 will still be characterized by growth, albeit at a weakened pace.

Outlook: Erste Group remains on a solid growth track

Against the backdrop of its current expectations for macroeconomic developments in its core markets, Erste Group expects net loan growth in the mid-single digits in 2022. This performance, as well as stronger than expected interest rate tailwinds, should lead to an at least high single-digit increase in net interest income -- despite still negative policy rates in the euro zone. Net fee and commission income is expected to rise in the mid-single digits. As in 2021, Erste Group aims to achieve a double-digit return on tangible equity (ROTE). Erste Group’s CET1 ratio is expected to remain strong.

Erste Group believes that in 2022 risk costs will be below 20 basis points of average gross customer loans. The NPL ratio is expected below 3.0%.

The evolving Russia-Ukraine situation does not impact Erste Group directly, as it has no operating presence in those countries; exposures to both countries are negligible and no additional risk provisioning is currently anticipated in this context. Indirect effects, such as financial market volatility or sanctions-related knock-on effects on some of our customers, cannot be ruled out, though.

Press release: Erste Group outlook: CEE economies proving resilient so far (PDF · 173 KB)Q1 results: Erste Group starts 2022 with a strong operating performance